.webp?width=807&height=245&name=asd%20(3).webp)

When doing business of any kind, it pays to know how to capitalize on every strength and weakness there is to make the endeavor thrive. The economy, in all of its unpredictability, is something that everyone has to live with. It's just the reality. Investors, and frankly anyone that deals with money, deal with all types of risks on a daily basis before they could turn their investments into profits.

Because of the number of risks involved, it pays to have somebody share some knowledge about the tools of the trade before jumping into any type of transaction. When it comes to the gold trade, there are a lot of things one can do to gain a little bit of advantage.

Also read: 2019 Spring Fashion and Jewelry Trends

Selling Gold but Where are the Buyers?

A person who decides to sell gold coins would soon find out that there are always buyers out there. However, how do you really choose a buyer? How do you guarantee and identify a good profit margin?

To answer these questions, we sat down with Fima Kandinov, an expert jewelry and coins appraiser for Luriya, to talk about a few great tips on how to succeed in the gold coin trade.

If you also have questions about jewelry, head on to the Luriya website to get more information about selling diamonds, silver, jewelry, and other precious stones.

Are My Coins Worth Selling?

When selling gold coins, the first thing you need to make sure of is that your coins are worth selling.

"The quickest solution is to bring your coins to an expert dealer or an appraiser and have them assessed. Use the information you get as references when you visit your buyer's office to negotiate an offer," says Kandinov.

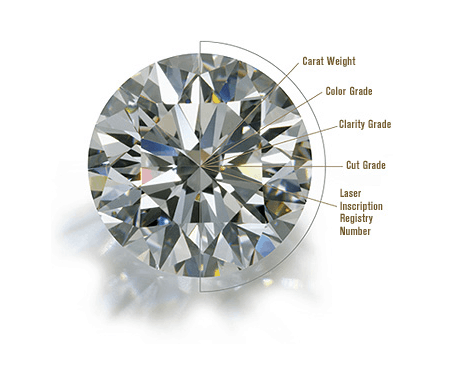

There are plenty of ways on how to sell gold coins but you need to know exactly which will give you the best profit. Just like diamonds and their 4Cs, coins also have some telltale signs that determine its worth.

Coin Grading

This is the condition of your coin, which largely rests on how much it was handled. Coins that never went into circulation will not be as worn as a penny that has been handled every day for the past 30 years. A coin that is lustrous and has most of its detail preserved will be worth a lot more than one that is “well-used”.

Coin Rarity

Sometimes a coin will be rare because it was never meant to be issued. An example of this is the 1933 double eagle gold coin, which was meant to be melted down after the Gold Reserve Act of 1934 was passed. Some other times a coin will be issued for a very short period (like the 20¢ piece that was minted from 1875-78). As with most items, supply influences the price.

Interest

The other side of supply is demand, and it’s an indicator of how interested people are in buying your coin. Interest can be harder to determine than other factors because most people don’t know how many coin collectors are interested in buying their coin. A good buyer will have a general idea of how much demand there is for a certain coin. However, a coin can lose its appeal or become more popular over time.

Liquidity

Liquidity is how fast a buyer can expect to sell the coin he or she is buying from you. If a buyer knows that he has a customer who is looking for your exact coin, then he will be motivated to buy at a higher price. If a buyer thinks that your coin could be valuable in the future, but knows that currently, no one is looking to buy it, then the amount he quotes you could be lower.

Pro tip: The thing that people forget the most is that if they think their coin is rare or valuable, they could always ask an appraiser to determine its value! Bring your coins to an expert dealer or an appraiser and have them assessed.

My Coins Have Value, Now What?

"Usually, it depends on what type of value your coin has," begins Kandinov. "Coins with historical significance in them, for example, will not sell well to an ordinary gold coin dealer. S/he will most likely base his/her price offer on just the coin’s authenticity and carat weight. An auction site and a numismatic coin dealer, however, will give you better pay. These places consider historical significance as a valuable factor in gold coins. The trick is to know which buyer will appreciate the qualities of your gold more."

Another way to check your coin’s value is to compare it to others online. A good tool for doing this is PCGS’s price guide. If the coins you have don’t look like any you can find online, then you may want to check if your coin is counterfeit.

I'm Ready to Sell My Coins, What are My Options?

Now that you know your coin's value, it's time to get familiar with the market.

As in any form of business, you need to be knowledgeable of your industry. Know what market forces affect the demand and pricing of gold coins. You need to understand these factors so you know when you have an advantage. Keep track of dollar’s value as this will tell you when it is a good time to sell gold coins. A good rule to remember is, when the dollar drops, gold value rises. So when the value of gold is in a good spot, sell away.

The best way to approach a coin buyer is with a ballpark estimate of what your coin is worth. One way you can do this is by purchasing a “Red Book”, a guide that is commonly used by coin buyers and sellers. The prices here are “sale” prices and are what you can expect to pay if you’re buying a coin. If you’re selling, then a better indicator of selling prices can be found in either the “Blue Book” or “Graysheet”, both of which list wholesale coin prices. These are the prices that dealers pay when buying coins from other dealers, but may not be entirely accurate due to bulk pricing.

Selling Coins - Is It Wise To Protect My Investment?

"Gold trade is tricky and protecting your stuff will always be wise," says Kandinov. "There can be a lot of money involved in this trade so you should always be careful in dealing with people you are unsure of."

An informed seller will make a great sale. If you’re looking to offload your collection, take the time to get some quotes on your coins before thinking about committing. A reputable buyer will let you consider all offers on the table before selling your coins.

"Always make sure that you are dealing with legitimate buyers," adds Kandinov. "This is the best way you could protect your goods."

Gold trade continues to be a strong industry today. This means that a seller can make a considerable amount of money by selling a few pieces of authentic gold coins. Gold is a precious and expensive metal, thus you need to be determined to get the best price you can from a dealer. This will only be possible if you equip yourself with a proper understanding of the market and some important tricks of the trade. Hence, keep these tips in mind and make sure your next sale is a big one.